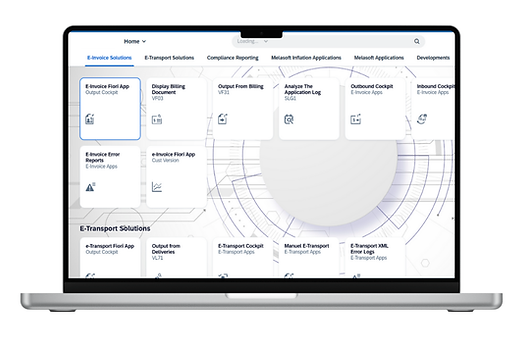

UAE E-Invoicing Solution

The UAE is rolling out mandatory e-invoicing, starting with a pilot in July 2026 and moving to phased implementation based on taxpayer size and entity type.

To comply, businesses must issue e-invoices and credit notes via accredited service providers and exchange them through a Peppol based DCTCE five corner model. Melasoft is a Peppol Access Point with experience in 30 plus countries, helping you get ready for UAE e-invoicing.

SAP E-Invoicing Solution for the UAE

Quick Complaince in 2 Weeks

Get your SAP ECC and SAP S 4HANA invoicing flow ready for the UAE e invoicing rollout starting with the July 2026 pilot and moving to phased mandatory adoption.

Legal security and architecture

The UAE uses a Peppol based DCTCE five corner model where e invoices are exchanged through accredited service providers, with structured invoice data and compliance reporting expectations.

AI powered automation

Reduce manual work in AP and AR with automated validation, field mapping support, monitoring, and exception handling for smoother e invoicing operations.

Timeline and phased roll-out for UAE e-invoicing

The UAE e invoicing mandate will roll out in phases starting 1 July 2026. Key deadlines depend on your business size, so it is important to identify your group early and plan your Accredited Service Provider onboarding in time.

Key dates:

1 July 2026: Pilot phase begins with a selected group of taxpayers.

31 July 2026: Businesses with annual revenue AED 50 million or more must appoint an Accredited Service Provider and be ready for go live by 1 January 2027.

31 March 2027: Businesses with annual revenue below AED 50 million must appoint an Accredited Service Provider and be ready for go live by 1 July 2027.

1 October 2027: Government entities must comply fully.

The UAE e invoicing model and Peppol framework

How Will E Invoices Be Exchanged in the UAE?

The UAE uses a Peppol based DCTCE five corner model. This means every e invoice is exchanged as structured data through accredited service providers and reported to the Federal Tax Authority.

%202.png)

The invoice flow:

Your system (ERP, billing, accounting).

Your accredited service provider (sender ASP).

Buyer’s accredited service provider (receiver ASP).

Buyer’s system.

Federal Tax Authority (FTA) reporting.

You can no longer rely on PDF email invoicing once the mandate applies.

E-invoices must flow through this Peppol based infrastructure.

Talk to Our Sales Team in Your Language

.png)

Mohammed Bouhaba

SAP Sales

Consultant

Languages Spoken

Moritz Junker

Automation & E-Compliance

Consultant

Languages Spoken

Emil Momberg

Partnertship

Consultant

Languages Spoken

Süleyman Çelik

Chief Executive

Officer

Languages Spoken

Prefer a Meeting

If you want to go straight to a call, book a meeting with our team now.

Preparation process for UAE e invoicing

UAE e invoicing requires a simple step by step preparation. First, understand what you need to change and choose your Accredited Service Provider. Then connect your ERP or billing system, map your invoice data, and test the full flow. When you go live, monitor the process, handle exceptions, and keep improving for smoother invoicing.

Who is in the scope?

Based on the UAE rollout approach, e invoicing will apply first to:

VAT registered businesses

Medium and large enterprises

High volume transaction sectors, such as:

Construction

Logistics

Travel and tourism

Professional services

E- commerce

SMEs will follow in later phases and are not exempt.

Accepted E-ınvoice format in the UAE

UAE e-invoices must be issued as structured invoice data, not as simple PDFs. Invoices will be exchanged through the Peppol network using the UAE approved schema based on Peppol standards such as PINT AE.

What this means for you:

-

Your ERP must generate structured invoice data

-

PDF only invoices will not be compliant once the mandate applies

-

Correct field mapping is required to avoid rejections

How Melasoft Helps You Get Ready

Melasoft supports companies of all sizes in preparing for the UAE e- invoicing mandate with:

-

Peppol based DCTCE five corner model readiness

-

Accredited Service Provider onboarding support

-

PINT AE aligned structured invoice data mapping

-

SAP ECC and SAP S 4HANA integration support

-

ERP and billing system integrations for non SAP environments

-

Validation, monitoring, and exception handling workflows

-

Secure archiving and audit ready invoice trails

-

ISO 27001 certified infrastructure

-

Peppol Access Point with experience in 30 plus countries

Move forward with a trusted partner that turns UAE requirements into a smooth rollout.