Oman E-Invoicing Solution

Prepare for August 2026

Oman is restarting its national e invoicing program to accelerate the shift from paper and PDF invoices to structured, standardised e invoices. The first mandatory wave is expected to start in August 2026 for the 100 largest taxpayers, followed by phased rollout through 2028.

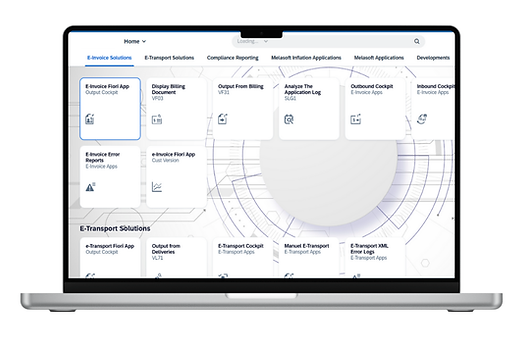

Melasoft helps organisations connect ERP and billing systems to national e invoicing models with audit ready controls and scalable integration.

SAP E-Invoicing Solution for the Oman

Quick Complaince in 2 Weeks

Get your SAP ECC and SAP S 4HANA invoicing flow ready for the UAE e invoicing rollout starting with the July 2026 pilot and moving to phased mandatory adoption.

Legal security and architecture

The UAE uses a Peppol based DCTCE five corner model where e invoices are exchanged through accredited service providers, with structured invoice data and compliance reporting expectations.

AI powered automation

Reduce manual work in AP and AR with automated validation, field mapping support, monitoring, and exception handling for smoother e invoicing operations.

Oman E-Invoicing Timeline

Oman’s program is planned as a phased implementation, starting with the largest taxpayers and expanding gradually to broader groups.

Expected milestones

2025

-

Consultations and model design

-

Publication of technical specifications

-

Publication of service provider requirements and training workshops

2026

-

Developer enablement and pilot preparation

-

Service Provider registration and accreditation opens

-

August 2026 first mandatory wave for 100 largest taxpayers (selected by the authority)

2027

-

Expansion to additional B2B taxpayer groups

2028

-

Further expansion expected, including B2G transactions

Oman’s e-invoicing 5 corner model

Oman is expected to implement a 5-corner model, where e invoices move through accredited service providers rather than being exchanged directly between buyer and supplier. This approach supports controlled exchange, consistent standards, and more reliable compliance processes.

The 5 corner model how invoices are expected to move

Corner 1 - Supplier

The supplier creates the invoice in an approved system (ERP or billing solution).

Corner 2- Supplier Service Provider

The invoice is sent to the supplier’s accredited service provider for exchange and compliance handling.

Corner 3 - Network exchange

The service provider transmits the invoice through the interoperable network to the buyer side.

Corner 4 - Buyer Service Provider

The buyer’s service provider receives and delivers the invoice into the buyer’s environment.

Corner 5 - Buyer and authority enablement

The buyer receives the structured invoice for processing, while required compliance data and controls are supported through the accredited provider model.

Talk to Our Sales Team in Your Language

.png)

Mohammed Bouhaba

SAP Sales

Consultant

Languages Spoken

Moritz Junker

Automation & E-Compliance

Consultant

Languages Spoken

Emil Momberg

Partnertship

Consultant

Languages Spoken

Süleyman Çelik

Chief Executive

Officer

Languages Spoken

Prefer a Meeting

If you want to go straight to a call, book a meeting with our team now.

Oman e Invoicing (Fawtara) at a glance

Oman’s e invoicing program (Fawtara) is moving forward to replace paper and PDF invoices with structured e invoices exchanged through accredited service providers under a 5 corner model. With the first wave expected from August 2026 and phased expansion through 2028, early preparation is key.

As a certified Peppol Access Point, Melasoft helps you make your ERP and invoicing flow Oman ready with integration, testing, and audit ready controls.

Who will be affected?

The rollout is expected to begin with large companies and mid-sized businesses as early adopters. As the program expands, all VAT registered businesses in Oman are expected to transition to e invoicing.

This typically includes:

-

Retail and wholesale businesses

-

Service providers and professional firms

-

Industrial and manufacturing companies

-

Public sector organisations that process VAT related invoices

How to Prepare for E-Invoicing in Oman

Register and confirm your scope

Review your VAT status and confirm whether your entity is included in the first wave or a later phase of the rollout. If registration or onboarding steps are required by the Oman Tax Authority, ensure they are completed early to avoid delays.

Select an accredited service provider

Identify an Oman Tax Authority (OTA) accredited service provider (or an approved platform when accreditation is opened) to support compliant exchange and reporting. Ensure the provider can handle your expected invoice volumes and supports your ERP landscape.

Set up archiving and record retention controls

Ensure invoices are stored securely with traceability, integrity, and easy retrieval for audit purposes. Align retention settings with local requirements and internal governance so e invoices remain verifiable over time.

Validate ERP readiness for structured invoices

Check whether your ERP can generate invoice data in structured formats such as XML or JSON. If native output is limited, plan an integration approach using middleware, a connector, or an e invoicing layer that can transform your invoice data into the required structure.

Configure, integrate, and test end to end

Set up the integration between your ERP, your e invoicing solution, and the national platform (Fawtara). Run test cycles to validate mapping, business rules, and error handling so invoices flow reliably before go live.

How partnering with Melasoft helps

Melasoft supports Oman readiness from strategy to go live with a compliance first, integration focused approach.

-

Readiness assessment: We review your invoicing process, ERP setup, formats, and archiving to identify gaps for Oman’s model.

-

ERP integration design: We design end to end structured invoice flows across SAP and non SAP environments.

-

Service Provider strategy: We define the right connectivity model and responsibilities as accreditation progresses.

-

Compliance controls: We build audit ready traceability, validations, monitoring, and error handling.

-

Testing and rollout support: We support testing, user enablement, go live monitoring, and ongoing compliance updates.